54

rates during the second or third quarters of 2015, our

strategy for the year involved holding bonds to maturity,

with only a small increase in our overall position of such

instruments. The average yield on all bonds, irrespective

of denomination, rose by 0.11 percent to 2.45 percent

from 2.34 percent in the previous year.

In terms of our investment strategy for equity assets,

having previously pursued holdings of available-for-sale

assets, in November we disposed of all such holdings

so as to satisfy a requirement for substantial holdings of

working capital. The overall rate of return on investment

was 35 percent, equivalent to an annualized return of

10 percent, yielding an injection of NT$44.89 million in

working capital.

With financial operations having involved the disposal

of index funds and equity assets, yields on financial

investments, including exchange gains (losses) and other

gains (losses), rose to 2.11 percent from 1.58 percent

the previous year. Annual revenue derived from financial

investments rose by NT$53.52 million, or 34.6 percent,

to NT$208.24 million from NT$154.72 million in the

previous year, exceeding a target of NT$137.70 million by

NT$70.54 million, or 51 percent.

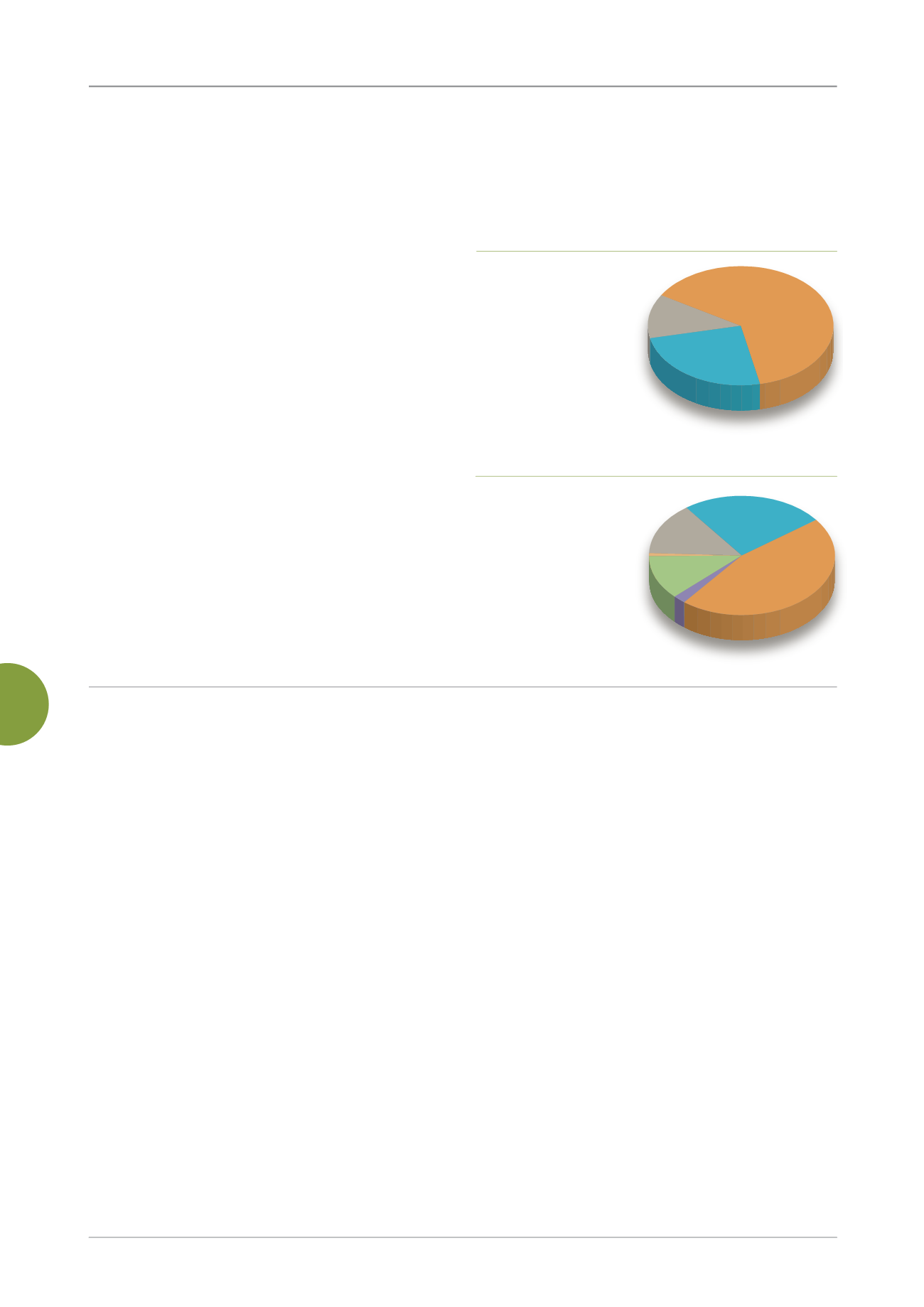

Figure 5 Investment Management (2014)

Investments for Development

Projects 12% ................

Financial Investments 63%

Lending for Development

Projects 25%

.........................

................

Investments for Development

Projects 12%

Index Funds / Equity

Assets 1% ...............

.............

Bank Deposits /

Short-term Notes 2%

...................

Time Deposits 46%

...........................................

Lending for Development

Projects 25%

............................................

.............................

Bonds 14%

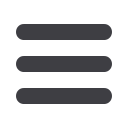

Figure 4 Fund Utilization (2014)

Investments for Development

Projects 12% ................

Financial Investments 63%

Lending for Development

Projects 25%

.........................

................

Investments for Development

Projects 12%

Index Funds / Equity

Assets 1% ...............

.............

Bank Deposits /

Short-term Notes 2%

...................

Time Deposits 46%

...........................................

Lending for Development

Projects 25%

............................................

.............................

Bonds 14

Accounting Management

The TaiwanICDF’s revenues are derived predominantly

from interest accrued on the Fund, interest from lending

operations and funding for MOFA-commissioned projects.

Interest accrued on the Fund and interest from lending

operations mainly support routine operations, including

technical cooperation projects, humanitarian assistance,

scholarship programs and workshops. It also supports

the TaiwanICDF’s own administrative, management and

general expenses. MOFA provides the majority share

of funding for commissioned projects to support the

operation of overseas technical and medical missions,

and specially commissioned projects.

In 2014, operating revenues and non-operating

income and gains amounted to NT$1.37 billion, of which

NT$990.54 million was allocated for commissioned

projects, a decrease of 6.3 percent from 2013. Revenue

generated through the use of the Fund was NT$382.16

million, an increase of 35.99 percent from 2013, of which

interest on fund investments comprised the largest share

(41%), followed by revenues from lending and investment

operations (26%), gains on sales of investment (12%) and

cash dividends (2%), with other revenues representing

the remaining share (19%).

Expenditures for 2014 were NT$1.37 billion, of which

NT$990.54 million was for commissioned projects, a

decrease of 6.3 percent from 2013. Expenditures made

through the use of the Fund were NT$375.13 million, a

decrease of 1.92 percent from 2013.

Revenue exceeded expenditures by NT$7.02 million

during 2014, representing a difference of NT$108.50

million from the NT$101.48 million excess of expenditures

over revenue in the previous year. This was mainly due to

the generation of income through the disposal of certain

holdings and the severance of diplomatic relations with

The Gambia, which brought an end to cooperative

bilateral relations, resulting in a reduction in expenditures

associated with technical cooperation and lending and

investment operations.

Fund Utilization and Balance

As of December 31, 2014, the net balance of the

Fund was NT$15.73 billion (including founding and

donated funds of NT$12.47 billion, accumulated earnings

of NT$3.26 billion and unrealized gains on financial

instruments of NT$300,000). This represented a decrease

of 0.08 percent, or NT$13.04 million, from the end of 2013.