Apéndice

85

14. ACCUMULATED EARNINGS

The TaiwanICDF is registered as a consortium juridical person with the aim of strengthening international cooperation

and enhancing foreign relations by promoting economic development, social progress and the welfare of the people in

partner nations around the world. As the TaiwanICDF is a non-profit organization, distribution of income is not permitted in

accordance with its Articles of Association.

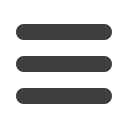

15. OTHER REVENUES

For the years ended

December 31, 2015

For the years ended

December 31, 2014

Reversal of allowance for doubtful accounts

$ 4,550,445

$ 4,839,579

Others

8,022,243

16,704,121

Total

$ 12,572,688

$ 21,543,700

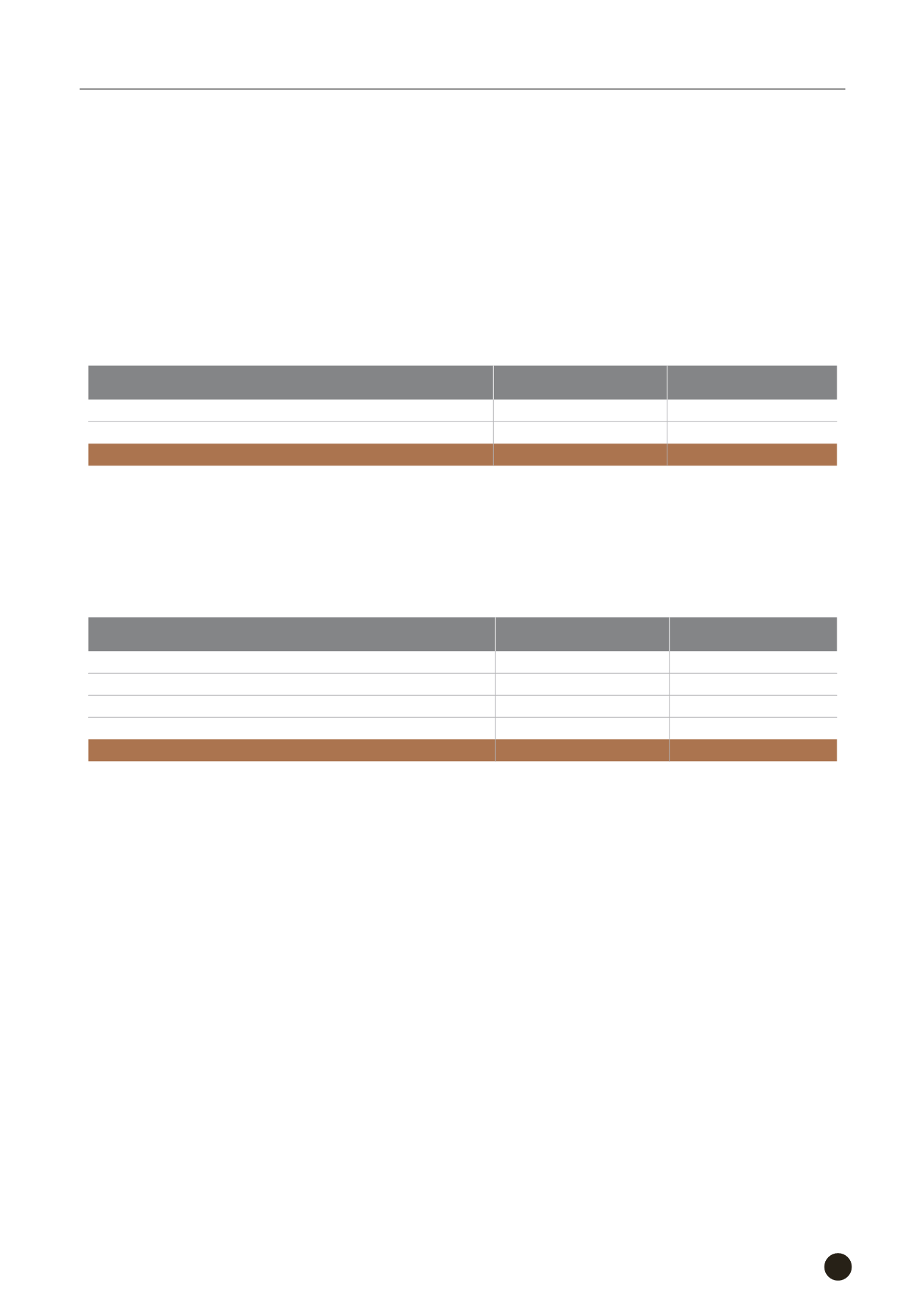

16. RETIREMENT FUNDS

1) The TaiwanICDF contributes monthly an amount based on seven percent of the employees’ remuneration and

deposits it with a financial institution. This fund balance is not reflected in the financial statements. The fund balance

with financial institution were NT$99,438,022 and NT$87,378,901 as of December 31, 2015 and 2014, respectively.

2) The account for employees’ retirement funds allocated by the TaiwanICDF was detailed as follows:

For the years ended

December 31, 2015

For the years ended

December 31, 2014

Balance at the beginning of the year

$ 87,378,901

$ 86,393,838

Interest income

1,112,852

1,041,320

Contribution during the year

10,946,269

4,000,000

Payments during the year

-

(

4,056,257

)

Balance at the end of the year

$ 99,438,022

$ 87,378,901

3) Effective September 1, 2009, TaiwanICDF has been the entity covered by the Labor Standards Law and has adopted

the following two schemes:

Scheme A: the pension and severance obligation are settled and the settled amounts are transferred to TaiwanICDF’s

retirement fund deposited with the financial institution. The employees may claim pension benefits when

they retire or reach 55 years old or upon their death.

Scheme B: the pension and severance obligation are not settled and the old pension plan is extended.

Accordingly, the TaiwanICDF recognized an accrued pension reserve of $16,014,156 for the excess of present value

of pension benefits for the past and future service years under the old pension plan over the fair value of the pension

fund at the measurement date, September 1, 2009 and contributed the amount to the account in 2010.

4) Effective September 1, 2009, the TaiwanICDF has established a funded defined contribution pension plan (the “New

Plan”) under the Labor Pension Act. Under the New Plan, the TaiwanICDF contributes monthly depending on the

contribution grades an amount based on 7% of the payroll grades corresponding to the employees’ monthly salaries

and wages to the employees’ individual pension accounts at the Bureau of Labor Insurance. The benefits accrued in

the employees’ individual pension accounts could be received in full or in monthly installments when the employees

retire. The pension costs under the New Plan for the years ended December 31, 2015 and 2014 amounted to

$17,806,629 and $10,769,383, respectively.