82

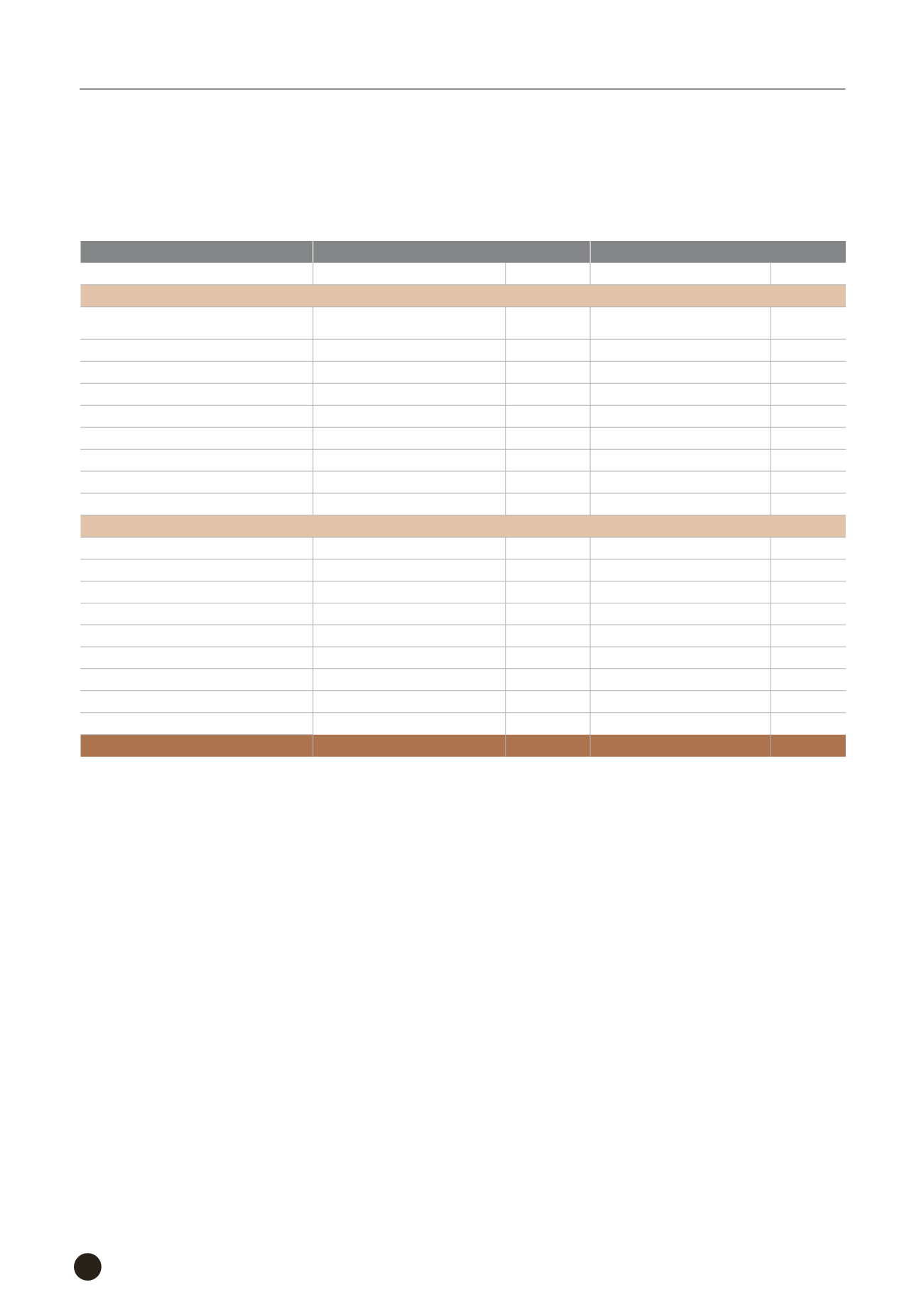

8. FINANCIAL ASSETS CARRIED AT COST

December 31, 2015

December 31, 2014

Carrying Amount (NT$)

Ownership

Carrying Amount (NT$)

Ownership

Equity investments accounted for using cost method:

Overseas Investment & Development

Corporation

$ 130,000,000

14.44% $ 130,000,000

14.44%

Less: Accumulated Impairment

(

6,000,000

)

(

6,000,000

)

124,000,000

124,000,000

BTS India Private Equity Fund Limited

124,583,261

6.80%

123,578,854

6.80%

(

=US$ 3,992,153

)

(

=US$ 3,959,840

)

Less: Accumulated Impairment

(

91,859,099

)

(

79,243,059

)

(

=US$ 2,995,225

)

(

=US$ 2,559,025

)

32,724,162

44,335,795

156,724,162

168,335,795

International institution investment fund:

FIISF-Small Business Account

-

325,000,000

(

=US$ 10,000,000

)

FIISF-Small Business Account

Ⅱ

330,660,000

330,660,000

(

=US$ 10,000,000

)

(

=US$ 10,000,000

)

FIISF-Small Business Account

Ⅲ

591,550,000

591,550,000

(

=US$ 20,000,000

)

(

=US$ 20,000,000

)

MIF-Specialized Financial Intermediary

476,300,000

476,300,000

Development Fund

(

=US$ 15,000,000

)

(

=US$ 15,000,000

)

1,398,510,000

1,723,510,000

Total

$ 1,555,234,162

$ 1,891,845,795

1) The TaiwanICDF engaged the European Bank for Reconstruction and Development (EBRD) to manage the Financial

Intermediary Investment Special Fund (FIISF)-Small Business Account and to jointly provide funds for loans in small

businesses. Under the agreement, the total investment amount was US$10,000,000, and the TaiwanICDF’s accumulated

contribution amounted to US$10,000,000 as of December 31, 2014. However, the programme was closed in June 2015

and the total contribution amount was withdrawn.

2) The TaiwanICDF engaged the Multilateral Investment Fund (MIF), which belongs to the Inter-American Development

Bank Group, to manage the Specialized Financial Intermediary Development Fund, a financing vehicle co-established

by the said two parties. MIF uses its own resources and the fund’s resources on a pari-passu basis to directly or

indirectly invest in, or make loans to well-performing microfinance institutions in Taiwan’s partner countries in Central and

South America. As of December 31, 2015 and 2014, the TaiwanICDF’s accumulated contribution to the fund amounted

to US$15,000,000.

3) The TaiwanICDF engaged the EBRD to manage the FIISF-Small Business Account Ⅱ and to jointly provide funds for

investments and loans in small businesses. Under the agreement, the total investment amount was US$10,000,000, and

the TaiwanICDF’s accumulated contribution amounted to US$10,000,000 as of December 31, 2015 and 2014.

4) The TaiwanICDF engaged the EBRD to manage the FIISF-Small Business Account Ⅲ and to jointly provide funds for

investments and loans in small businesses. Under the agreement, the total investment amount was US$20,000,000, and

the TaiwanICDF’s accumulated contribution amounted to US$20,000,000 as of December 31, 2015 and 2014.

5) The above listed foreign currency investments projects are stated using the historical exchange rate.