Financial Management

In financial planning, this year our investment was

guided by an actively defensive asset management

strategy, allocating to primarily fixed-income assets and

supplemented by risk-bearing assets. Balanced asset

allocation ensures the sufficient liquidity of the Fund and

the security of the Fund principals.

Any financial investment plan not related to our main

operations must be set with the priority to secure the funds

needed by the TaiwanICDF for our foreign aid development

projects, adhere to the past principle of appropriate asset

allocation, and precise control the maximum investment

ratio for the risk-bearing asset portion. In 2014, this

ratio ceiling was 2.55 percent of the Fund’s net worth.

Subsequently, with the Board’s resolution, this ratio ceiling

was raised to the current 6.37 percent in 2015 with a

view to using uncommitted funds to acquire stable, mid-

to-long term fixed income from investment. This income

is expected to help the TaiwanICDF achieve the goal of

sustainable development in our operations.

Fund Utilization

The TaiwanICDF’s fund balances (the Fund) are derived

predominantly from two sources: the founding fund and

donated fund; and accumulated earnings.

The Fund is used for reimbursable international

cooperation and development projects, such as long-term

investment and lending development projects. To enhance

the effectiveness of fund utilization, a portion of the

uncommitted Fund is set aside and invested in a portfolio

of financial instruments. Such investments take the form of

fixed-income instruments, such as bonds, bank deposits

and short-term investments, supplemented by risk-bearing

instruments in the form of exchange-traded funds (ETF).

Annual earnings are mainly derived from interests and

revenues from long-term capital investments or lending

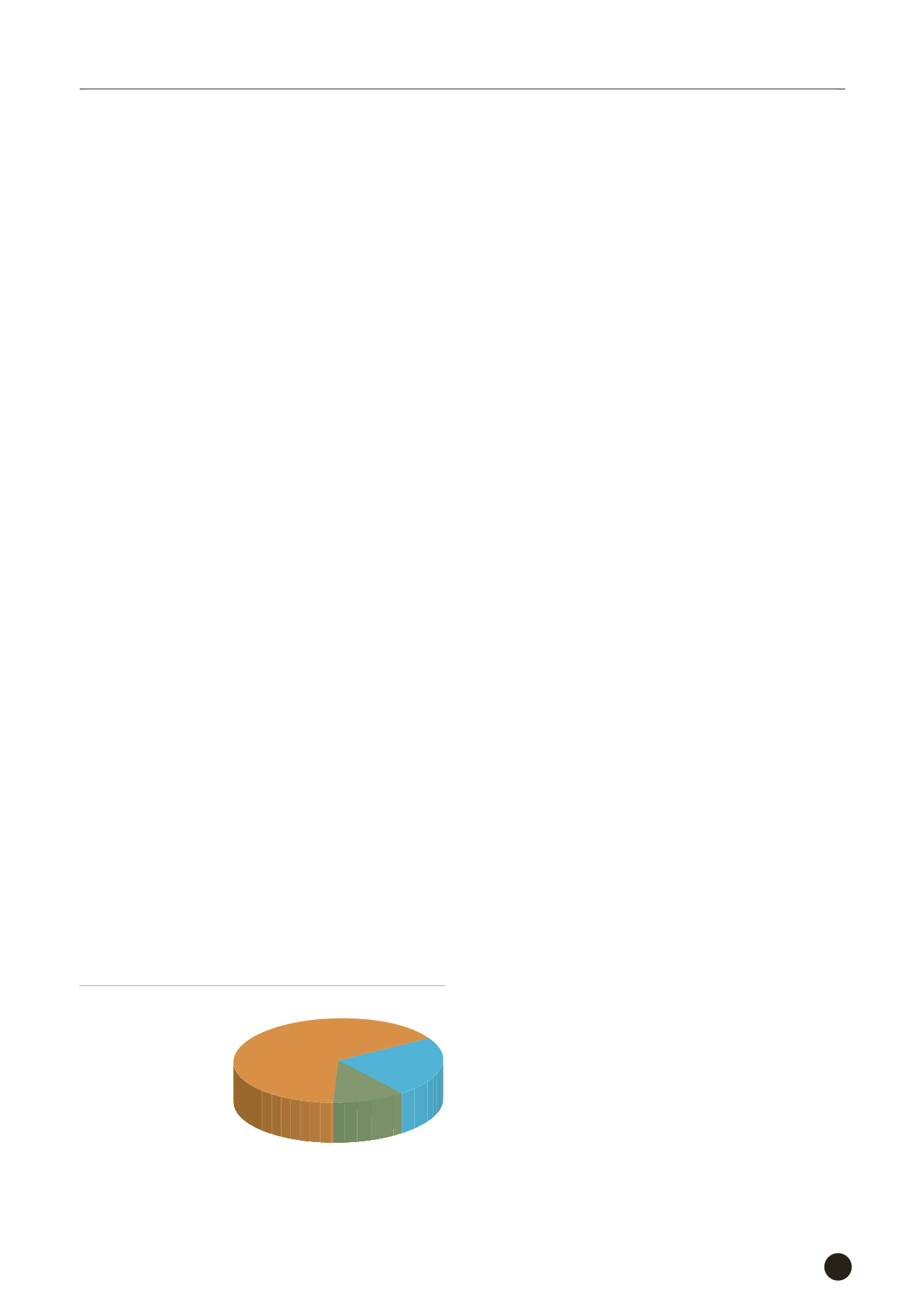

Investments for Development

Projects 11%

...................................

Financial Investments 66%

...................

Lending for Development

Projects 23%

..........................................

Figure 1 Fund Utilization (2015)

Administration

61

development projects, as well as from investments in a

portfolio of financial instruments. These are used to finance

international projects on a non-reimbursable basis and

operational expenses. As of December 31, 2015, the total

outstanding amount of long-term investment and lending

development projects comprised 34 percent of the Fund,

while 66 percent was allocated to a portfolio of financial

instruments. Accounting for commitments made but not

yet fulfilled, the value comes to 59 percent of total fund

balances, while financial instruments accounted for 41

percent.

In 2015, the overall rate of return for the Fund was

1.84 percent excluding foreign exchange gains (losses)

and other income (expenses), and 2.37 percent when

accounting for foreign exchange gains (losses) and other

income (expenses). Of this, the rate of return for long-term

investment and lending development projects was 2.03

percent and financial investments 1.74 percent. Annual

revenue (excluding foreign exchange gains (losses) and

other income (expenses)) was around NT$290.37 million.

Accounting for foreign exchange gains (losses) and other

income (expenses), annual revenue comes to around

NT$374.21 million.

In 2014, the TaiwanICDF had a gain of NT$44.89 million

through the disposal of exchange-traded fund investments

so that annual revenue in 2014 was NT$381 million.

Although there was a drop in annual revenue of around

NT$6.79 million in 2015 excluding the income from ETF,

the difference was 1.78 percent. Compared to an annual

income of NT$274.5 million in 2013, this represented an

increase of NT$99.71 million or 36.3 percent. Financial

investment revenue distribution from 2013 to 2015 is shown

in Figure 2.

Management of Long-term Lending and

Investments

As of December 31, 2015, the TaiwanICDF was

committed to 14 long-term investment projects, for

which the balance of investments stood at US$46.99

million and NT$124 million. There were also 85 lending

development projects with approved loans of US$522.45

million, €56.55 million, and other currencies equivalent to

US$18.1 million. Accumulated loan disbursements stood

at US$447.65 million, €20.84 million and in other currencies

equal to US$8.5 million, equivalent to 83.18 percent of all

commitments, while total loan principal repayments stood

at US$387.79 million, equivalent to 75.13 percent of all

funds extended.

As for revenue derived from reimbursable long-term

investment and lending development projects, interest