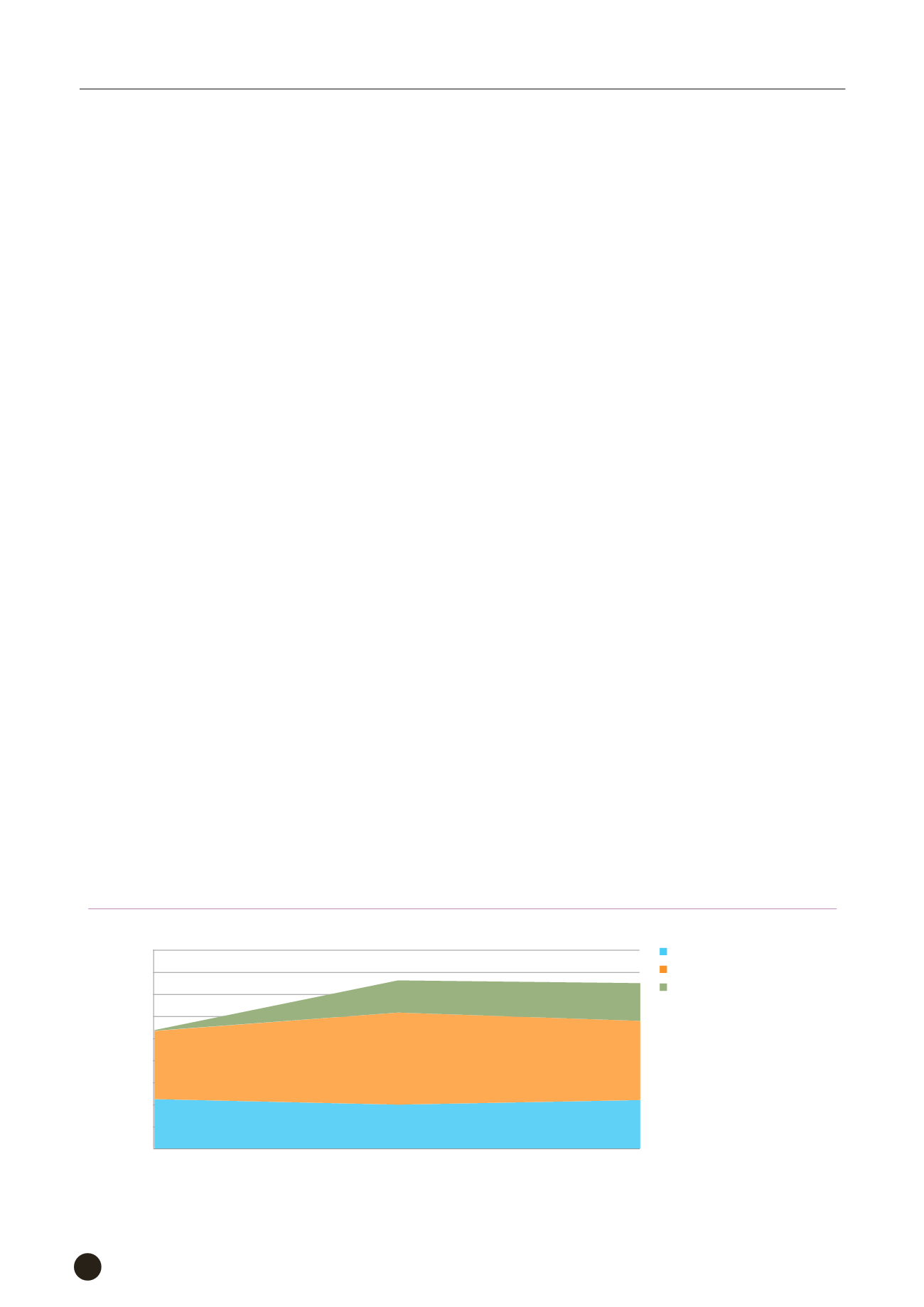

62

earned in 2015 from lending development projects stood

at NT$ 91.9 million, for a rate of return of 2.53 percent

(compared to 2.71 percent in 2014, a fall of 0.18 percent).

In 2015, two investment projects contributed to a profit

of NT$17.36 million for a return rate of 0.99 percent.

Total aggregated return on long-term investment and

lending development projects was NT$192.5 million with

a combined return rate of 2.03 percent. Compared to

a total aggregated income in 2014 of NT$99.64 million,

this represents an increase of around NT$9.61 million

(aggregated return rate in 2014 was 1.73 percent, an

increase of 0.30 percent), while compared to NT$112.35

million in 2013, a reduction of NT$3.1 million. In terms of

asset quality, as of December 31, 2015, there were no bad

debts or delayed payments, and in compliance with the

organization’s provisions on long-term loans, receivables,

and overdue payments, these were recorded as a reserve

for allowances for bad debts to provide a fair and objective

picture of asset quality.

Management of Uncommitted Funds

The financial investment of the uncommitted portion of

the Fund is designed to increase the efficiency with which

funds are used and to increase the TaiwanICDF’s revenues.

Currently these investments focus on fixed-income

financial instruments, supplemented by risk-bearing assets

in the form of exchange-traded funds by way of long-term

holdings of equities.

Fixed-income assets are primarily invested in

bonds, time deposits and short-term commercial paper

denominated in NT dollars and foreign currencies that are

held to maturity. With the delay in raising interest rates by

the U.S. government, the overall performance of interest

rates was sluggish. In 2015, we increased our bond

holding position, and the average rate of return gradually

rose from 2.34 percent in 2013 and 2.45 percent in 2014,

to 2.57 percent in 2015. In addition, the bond position as a

percentage of Fund net worth rose from 14 to 16 percent.

As for risk-bearing assets, with acceptable financial risks

in 2015, the Board of Directors agreed to increase the

upper limit for investment in risk-bearing assets. Thus, risk-

bearing assets rose from 2.55 percent of Fund net worth in

2014 to 6.37 percent, with exchange-traded fund holdings

increasing by 28 percent over the previous year and

dividend income increasing by 65 percent.

With our strategy in 2015 of raising the average return

of bond investments and expanding exchange-traded

fund investment to increase dividend income, financial

investment income, excluding foreign exchange gains

(losses) and other income (expenses), was NT$181.12

million, representing an increase of NT$17.77 million over

the NT$163.35 million (excluding disposed exchange-

traded funds capital gains of NT$44.89 million) of 2014,

registering an increase of 11 percent. Compared to

NT$154.72 million in 2013, this means an increase of

NT$26.4 million or 17 percent. In addition, compared to an

annual budget income target of NT$ 129.67 million, this

means an increase of NT$51.45 million, or 40 percent.

The rate of return for financial investments in 2015 was

1.74 percent whereas the previous year it was 2.11 percent

(NT$10,000)

45,000

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

0

2013

2014

2015

20,824

7,311

9,964

10,925

18,112

8,384

74

15,472

11,235

Lending and Investment

Financial Investments

Exchange and Other Gains (Losses)

Figure 2 Fund Revenue (2013-2015)