77

Appendix

14. ACCUMULATED EARNINGS

The TaiwanICDF is registered as a consortium juridical person with the aim of strengthening international cooperation

and enhancing foreign relations by promoting economic development, social progress and the welfare of the people

in partner nations around the world. As the TaiwanICDF is a non-profit organization, distribution of income is not

permitted in accordance with its Articles of Association.

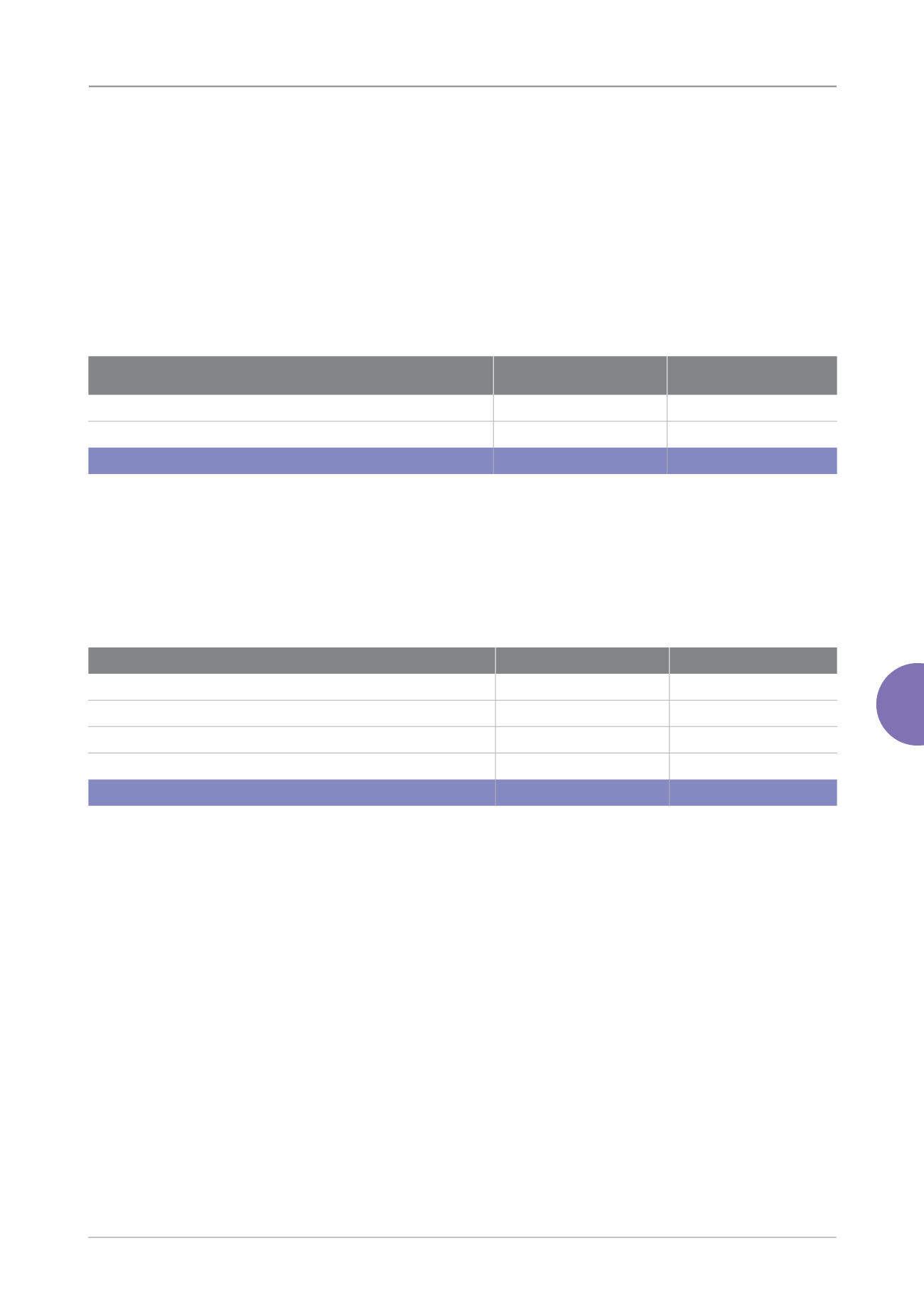

15. OTHER REVENUES

For the years ended

December 31, 2014

For the years ended

December 31, 2013

Reversal of allowance for doubtful accounts

$ 4,839,579

$ 4,453,537

Others

16,704,121

9,451,588

$ 21,543,700

$ 13,905,125

16. RETIREMENT FUNDS

1) The TaiwanICDF contributes monthly an amount based on seven percent of the employees’ remuneration and

deposits it with a financial institution. This fund balance is not reflected in the financial statements. The fund

balance with financial institution were NT$87,378,901 and NT$86,393,838 as of December 31, 2014 and 2013,

respectively.

2) The account for employees’ retirement funds allocated by the TaiwanICDF was detailed as follows:

2014

2013

Balance at the beginning of the year

$ 86,393,838

$ 92,318,901

Interest income

1,041,320

1,177,330

Contribution during the year

4,000,000

4,000,000

Payments during the year

( 4,056,257 )

( 11,102,393 )

Balance at the end of the year

$ 87,378,901

$ 86,393,838

3) Effective September 1, 2009, TaiwanICDF has been the entity covered by the Labor Standards Law and has

adopted the following two schemes:

Scheme A: the pension and severance obligation are settled and the settled amounts are transferred to

TaiwanICDF’s retirement fund deposited with the financial institution. The employees may claim pension

benefits when they retire or reach 55 years old or upon their death.

Scheme B: the pension and severance obligation are not settled and the old pension plan is extended.

Accordingly, the TaiwanICDF recognized an accrued pension reserve of $16,014,156 for the excess of present

value of pension benefits for the past and future service years under the old pension plan over the fair value of the

pension fund at the measurement date, September 1, 2009 and contributed the amount to the account in 2010.

4) Effective September 1, 2009, the TaiwanICDF has established a funded defined contribution pension plan (the

“New Plan”) under the Labor Pension Act. Under the New Plan, the TaiwanICDF contributes monthly depending on

the contribution grades an amount based on 7% of the payroll grades corresponding to the employees’ monthly

salaries and wages to the employees’ individual pension accounts at the Bureau of Labor Insurance. The benefits

accrued in the employees’ individual pension accounts could be received in full or in monthly installments when

the employees retire. The pension costs under the New Plan for the years ended December 31, 2014 and 2013

amounted to $10,769,383 and $10,246,497, respectively.