74

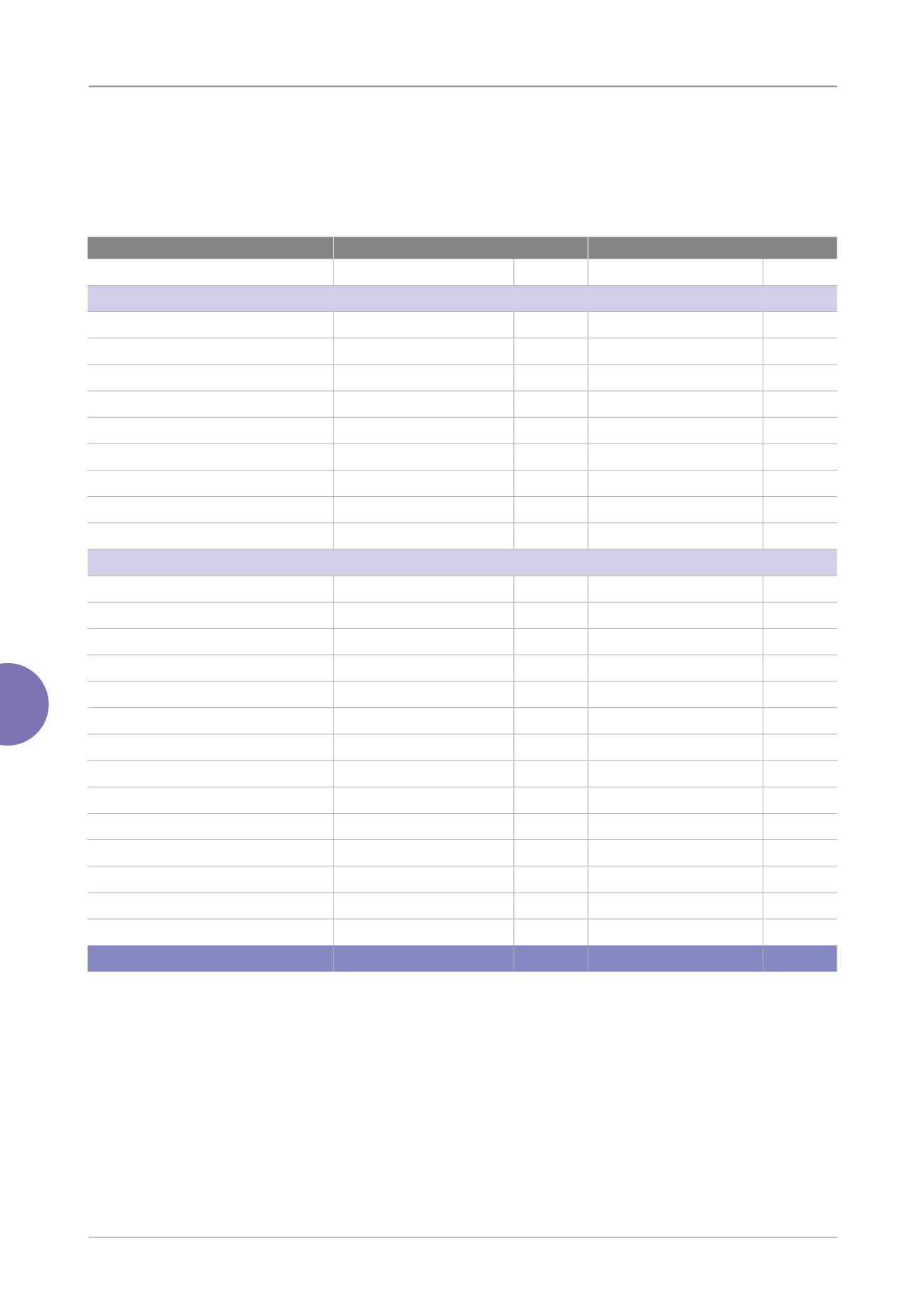

8. FINANCIAL ASSETS CARRIED AT COST

December 31, 2014

December 31, 2013

Carrying Amount (NT$)

Ownership

Carrying Amount (NT$)

Ownership

Equity investments accounted for using cost method

Overseas Investment & Development

$ 130,000,000

14.44% $ 130,000,000

14.44%

Less: Accumulated Impairment

( 6,000,000 )

( 6,000,000 )

124,000,000

124,000,000

BTS India Private Equity Fund Limited

123,578,854

6.80% 124,024,153

6.80%

(=US$ 3,959,840 )

(=US$ 3,975,147 )

Less: Accumulated Impairment

( 79,243,059 )

( 53,499,324 )

(=US$ 2,559,025 )

(=US$ 1,608,939 )

44,335,795

70,524,829

Net

168,335,795

194,524,829

International institution investment fund

FIISF-Small Business Account

325,000,000

325,000,000

(=US$ 10,000,000 )

(=US$ 10,000,000 )

FIISF-Small Business Account

Ⅱ

330,660,000

330,660,000

(=US$ 10,000,000 )

(=US$ 10,000,000 )

FIISF-Small Business Account

Ⅲ

591,550,000

410,650,000

(=US$ 20,000,000 )

(=US$ 14,000,000 )

MIF-Specialized Financial Intermediary

476,300,000

476,300,000

(=US$ 15,000,000 )

(=US$ 15,000,000 )

FIISF-Trade facilitation programme

-

161,750,000

(=US$ 5,000,000 )

Less: Accumulated Impairment

-

( 161,750,000 )

(=US$ 5,000,000 )

-

-

Net

1,723,510,000

1,542,610,000

Total

$ 1,891,845,795

$ 1,737,134,829

1) The TaiwanICDF engaged the European Bank for Reconstruction and Development (EBRD) to manage the

Financial Intermediary Investment Special Fund (FIISF)-Small Business Account and to jointly provide funds

for loans in small businesses. Under the agreement, the total investment amount was US$10,000,000, and the

TaiwanICDF’s ac-cumulated contribution amounted to US$10,000,000 as of December 31, 2014 and 2013.

2) The TaiwanICDF engaged the EBRD to manage the FIISF-Trade Facilitation Programme to provide trade finance

guarantees and loan facilities for local banks. Under the contract, the TaiwanICDF had invested US$5,000,000 as

of December 31, 2014 and 2013. Based on conservatism principle, the TaiwanICDF provided for impairment of

NT$161,750,000 in 2009. The programme has been terminated, and the guarantee period expired in 2013. The

EBRD has formally notified that the aforementioned loss was materialized and the programme was closed.