75

Appendix

3) The TaiwanICDF engaged the Multilateral Investment Fund (MIF), which belongs to the Inter-American

Development Bank Group, to manage the Specialized Financial Intermediary Development Fund, a financing

vehicle co-established by the said two parties. MIF uses resources of its own and the fund’s on a pari-passu basis

to directly or indirectly invest in, or make loans to well-performing microfinance institutions in Taiwan’s partner

countries in Central and South America. As of December 31, 2014 and 2013, the TaiwanICDF’s accumulated

contribution to the fund amounted to US$15,000,000.

4) The TaiwanICDF engaged the EBRD to manage the FIISF-Small Business Account Ⅱ and to jointly provide funds for

investments and loans in small businesses. Under the agreement, the total investment amount was US$10,000,000,

and the TaiwanICDF’s accumulated contribution amounted to US$10,000,000 as of December 31, 2014 and 2013.

5) The TaiwanICDF engaged the EBRD to manage the FIISF-Small Business Account Ⅲ and to jointly provide

funds for investments and loans in small businesses. Under the agreement, the total investment amount was

US$20,000,000, and the TaiwanICDF’s accumulated contribution amounted to US$20,000,000 and US$14,000,000

as of December 31, 2014 and 2013, respectively.

6) The above listed foreign currency investments projects are stated using the historical exchange rate.

7) After assessing the loss on the investment in BTS India Private Equity Fund Limited, the TaiwanICDF provided for

impairment of NT$25,743,735 and NT$42,692,839 in 2014 and 2013 based on conservatism principle.

8) See Appendix 2 for the statement of changes in financial assets carried at cost for the year ended December 31,

2014.

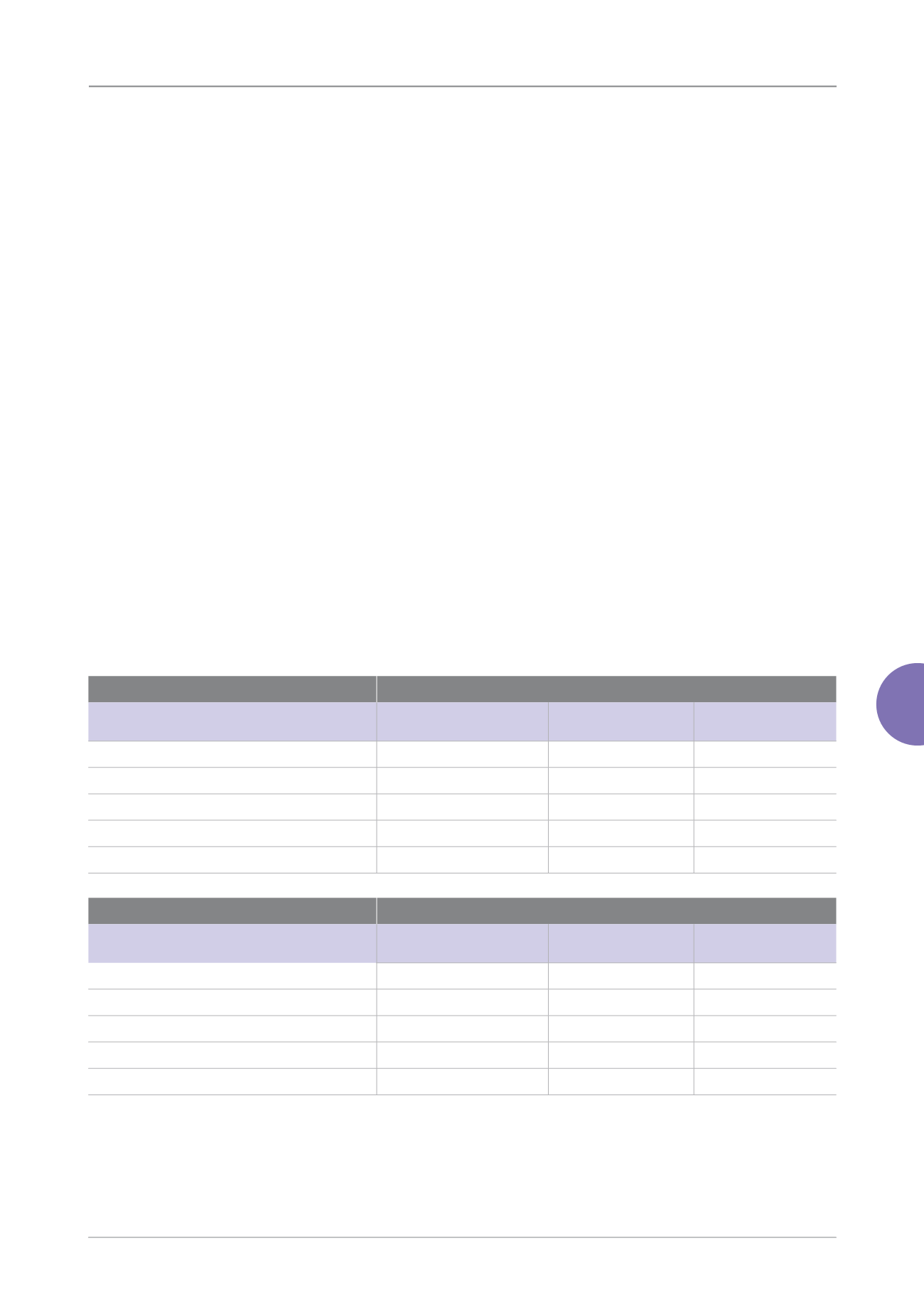

9. FIXED ASSETS

December 31, 2014

Cost

Accumulated

Depreciation

Net Book Value

Mechanical equipment

$ 33,530,680

$ 19,209,578

$ 14,321,102

Communication & transportation equipment

2,827,915

1,764,935

1,062,980

Miscellaneous equipment

3,836,515

2,665,017

1,171,498

Leasehold improvements

3,289,466

1,838,252

1,451,214

$ 43,484,576

$ 25,477,782

$ 18,006,794

December 31, 2013

Cost

Accumulated

Depreciation

Net Book Value

Mechanical equipment

$ 31,393,887

$ 20,882,379

$ 10,511,508

Communication & transportation equipment

2,847,815

1,597,960

1,249,855

Miscellaneous equipment

4,104,535

2,728,799

1,375,736

Leasehold improvements

2,309,466

1,448,587

860,879

$ 40,655,703

$ 26,657,725

$ 13,997,978

See Appendix 3 for the statement of changes in fixed assets for the year ended December 31, 2014.