36

Lending and Investment

In 2014, the TaiwanICDF’s lending

and investment operations drew

on accumulated development

advantages, focusing on creating

p r o d u c t i o n a n d o p e r a t i n g

environments of benefit to the private

sector in partner countries. This

involved, for instance, strengthening

financial intermediaries operating

in certain regions or countries,

providing further means for small-

scale enterprises to obtain financial

suppo r t , and a i d i ng Cen t r a l

American farmers by providing

agricultural financial services to those

hit by coffee rust. We also responded

to partner countries’ needs by

participating in environmental

protection projects, including waste

recycling and renewable energy

initiatives.

In terms of development assistance,

we strengthened the connection

between our operations and the

international interest rates market

by providing borrowers with loans

priced in floating interest rates that

aimed to promote our projects more

smoothly.

I n t e rms o f pr i va t e sec t o r

cooperation, in addition to bringing

together the practical viewpoints

of private sector actors, we also

invited such actors to participate in

investment projects such as a tilapia

feed mill and a waste treatment and

recycling project that aim to strike a

balance between development goals

and financial sustainability.

To ensure stability in terms of the

medium- and long-term development

o f i nves tmen t ac t i v i t i es , t he

TaiwanICDF has sought sustainability

based on a portfolio built upon the

past. In terms of lending operations,

we actively responded to partner

countries’ needs and customized

lending projects according to the

requirements of such countries’

national development frameworks.

For ongoing loan projects, we will

ensure that project scheduling makes

the most efficient use of resources

by reviewing processes and making

proper adjustments accordingly.

In terms of interactions with

international organizations, the

TaiwanICDF’s dialogue with such

organizations regarding potential

cooperation projects were based

on our operational priorities. We

also remained keen to acquire the

latest international practices and

professional know-how, applying

such learning in evaluating the

preparation and management of

lending and investment projects and

thereby assisting our organization in

building a regional framework and

implementation methodologies.

To safeguard investment projects,

this year saw the TaiwanICDF unite

in-house expertise, strengthening

legal structuring and appraisal in the

early stages of the preparation of

large-scale investment projects.

As of December 31, 2014,

the TaiwanICDF was committed

to 84 lending projects, for which

c omm i t me n t s amo u n t e d t o

approximately US$665.32 million. We

were also committed to 13 investment

projects, for which commitments

amounted to approximately US$100

million. We dispatched specialists

on a total of 22 occasions for the

purpose of attending international

c o n f e r e n c e s o r a s p a r t o f

identification, preparation, appraisal,

supervision or completion missions.

The TaiwanICDF’s Lending and

Investment Department was also

responsible for managing a number

of projects commissioned by MOFA,

as well as for managing the Republic

of China (Taiwan)-Central American

Economic Development Fund. In the

future the TaiwanICDF will continue

to respond to the demands of

partner countries and looks forward

to implementing various lending

and investment projects through the

integration of multiple operations

and applications of lending and

investment instruments.

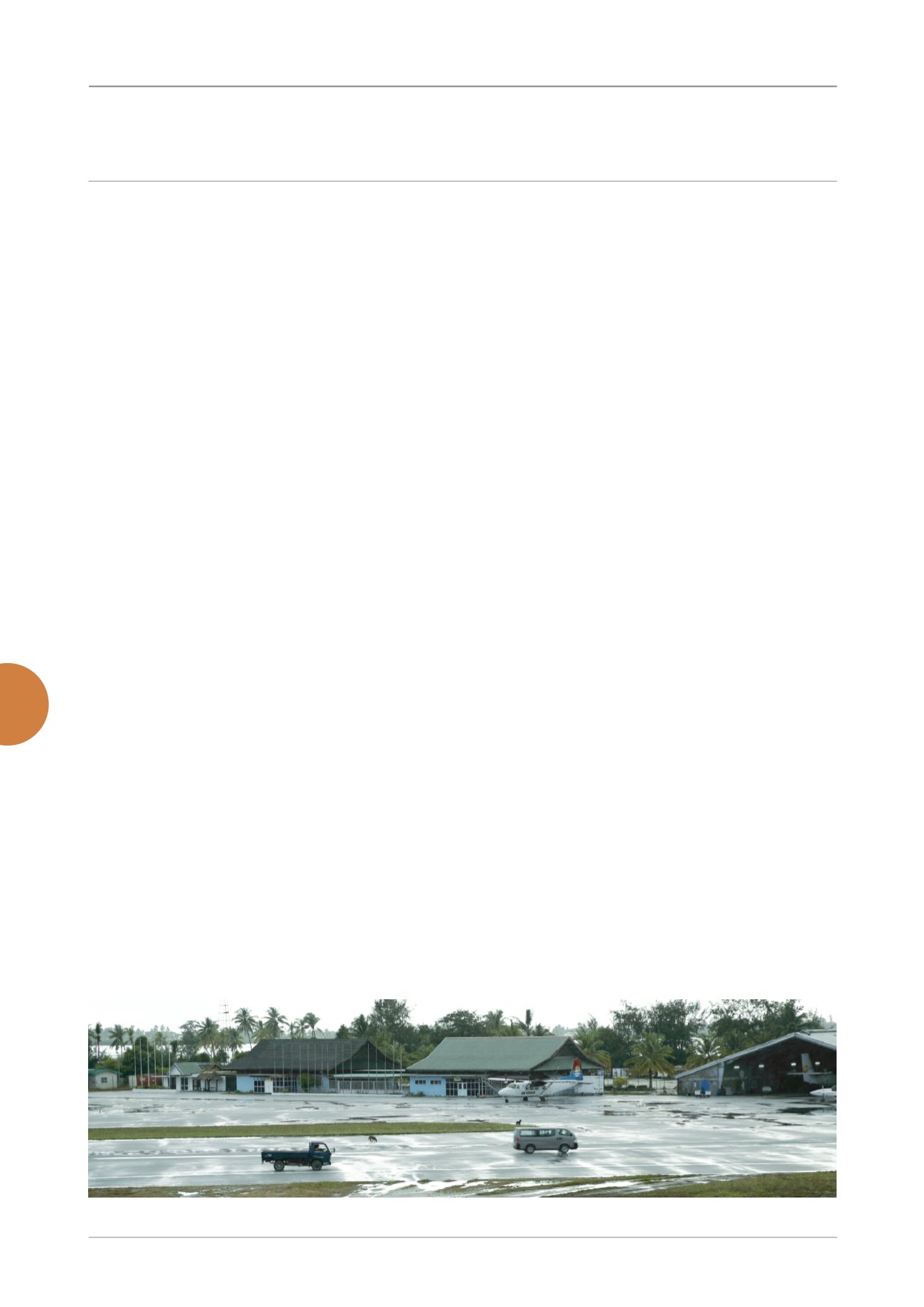

Responding to partners’ needs to develop air

transportation, a TaiwanICDF lending project

is assisting Kiribati in renovating facilities at

the capital city’s Bonriki International Airport.

Pictured here, the airport prior to renovation

work.