85

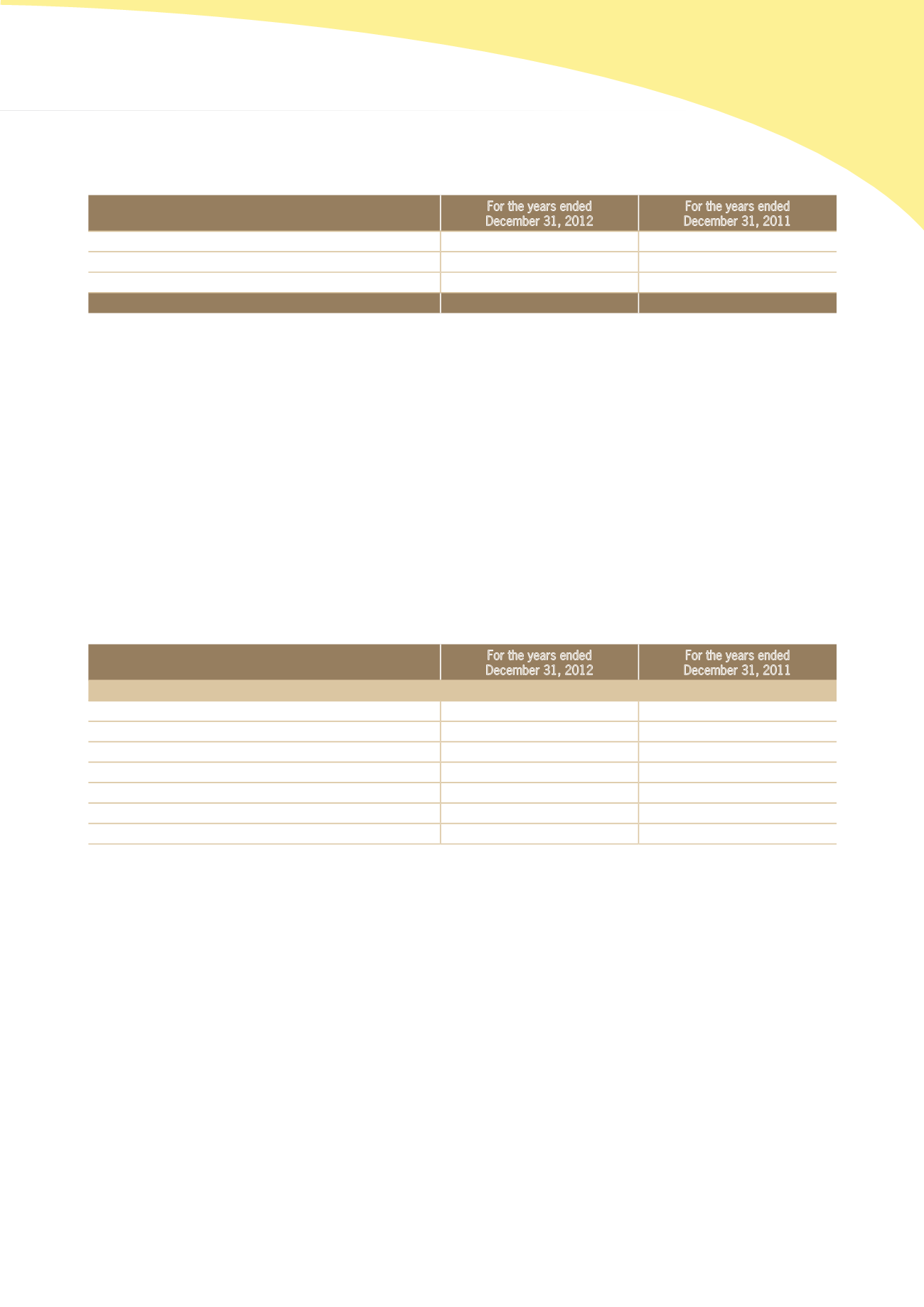

2) The account for employees’ retirement funds allocated by the TaiwanICDF was detailed as follows:

For the years ended

December 31, 2012

For the years ended

December 31, 2011

Balance at the beginning of the year

$96,399,979

$103,748,667

Interest income

1,465,525

718,494

Payments during the year

(5,546,603)

(8,067,182)

Balance at the end of the year

$92,318,901

$96,399,979

3) Effective September 1, 2009, TaiwanICDF has been the entity covered by the Labor Standards Law and has adopted

the following two schemes:

Scheme A: the pension and severance obligation are settled and the settled amounts are transferred to TaiwanICDF’s

retirement fund deposited with the financial institution. The employees may claim pension benefits when they retire

or reach 55 years old or upon their death.

Scheme B: the pension and severance obligation are not settled and the old pension plan is extended.

Accordingly, the TaiwanICDF recognized an accrued pension reserve of NT$16,014,156 for the excess of present

value of pension benefits for the past and future service years under the old pension plan over the fair value of the

pension fund at the measurement date, September 1, 2009 and contributed the amount to the account in 2010.

4) Effective September 1, 2009, the TaiwanICDF has established a funded defined contribution pension plan (the “New

Plan”) under the Labor Pension Act. Under the New Plan, the TaiwanICDF contributes monthly depending on the

contribution grades an amount based on 7% of the payroll grades corresponding to the employees’ monthly salaries

and wages to the employees’ individual pension accounts at the Bureau of Labor Insurance. The benefits accrued in

the employees’ individual pension accounts could be received in full or in monthly installments when the employees

retire. The pension costs under the New Plan for the years ended December 31, 2012 and 2011 amounted to

$6,524,908 and $5,817,564, respectively.

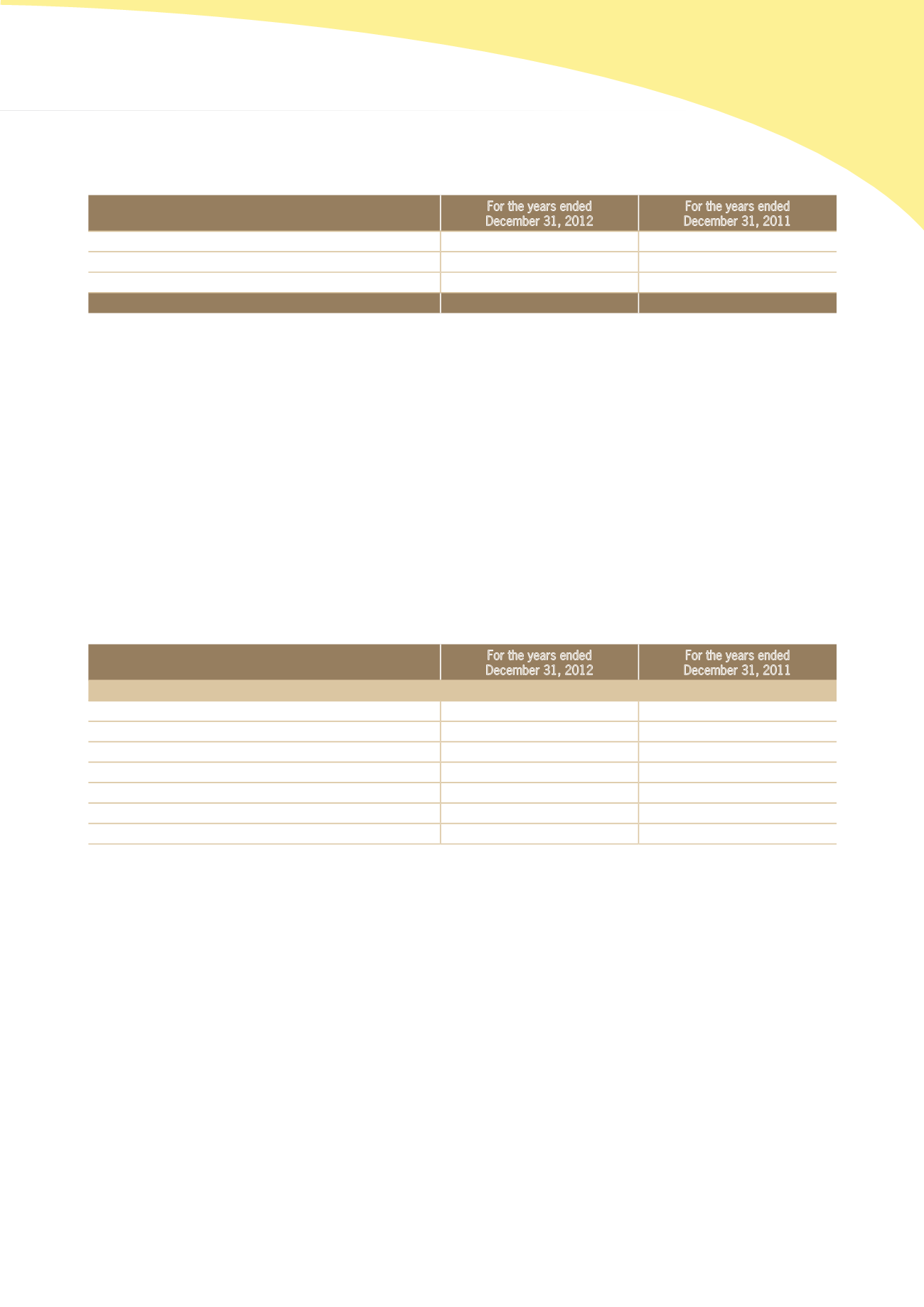

17. PERSONNEL, DEPRECIATION AND AMORTIZATION EXPENSES

For the years ended

December 31, 2012

For the years ended

December 31, 2011

Personnel expenses

Salaries

$115,232,022

$102,344,241

Labor and health insurance

8,658,716

7,713,810

Pension

6,524,908

5,817,564

Others

3,303,324

2,876,689

$133,718,970

$118,752,304

Depreciation

$3,901,583

$4,378,383

Amortization

$1,231,353

$919,993

18. COMMITMENTS AND CONTINGENCIES

1) Pursuant to the Regulations for Loans by the International Cooperation and Development Fund, the outstanding loans

denominated in U.S. dollars that the TaiwanICDF had signed agreements amounted to US$247,140,769.35 and

US$312,767,523.86 as of December 31, 2012 and 2011, respectively. The loans drawn down as of the said dates

amounted to US$213,947,697.63 and US$268,261,678.64, and the undisbursed committed balance amounted

to US$33,193,071.72 and US$44,505,845.22 as of December 31, 2012 and 2011, respectively. Additionally

the outstanding loans denominated in Euro amounted to

€

56,553,755.54. The loans drawn down as of the said

dates amounted to

€

20,837,674.52, and the undisbursed committed balance amounted to

€

35,716,081.02 as of

December 31, 2012 and 2011.

2) Pursuant to the Regulations for Investments by the International Cooperation and Development Fund, the committed

amounts denominated in U.S. dollars under the outstanding contracts entered into by the TaiwanICDF were

US$65,000,000, of which US$52,064,625 and US$51,996,598 had been invested as of December 31, 2012 and

2011, respectively. The balance of the commitment was US$12,935,375 and US$13,003,402 as of December

31, 2012 and 2011, respectively. Additionally, the committed amounts denominated in NT dollars under the

outstanding investment agreement entered into by the TaiwanICDF has been fully disbursed, with the balance of

NT$130,000,000 as of December 31, 2012 and 2011.

3) The TaiwanICDF had entered into a lease agreement with MOFA to lease state-owned real estate properties. As per

the lease agreement, the lease period is from October 1, 2010 to September 30, 2015 with the rents charged on a