Appendix

84

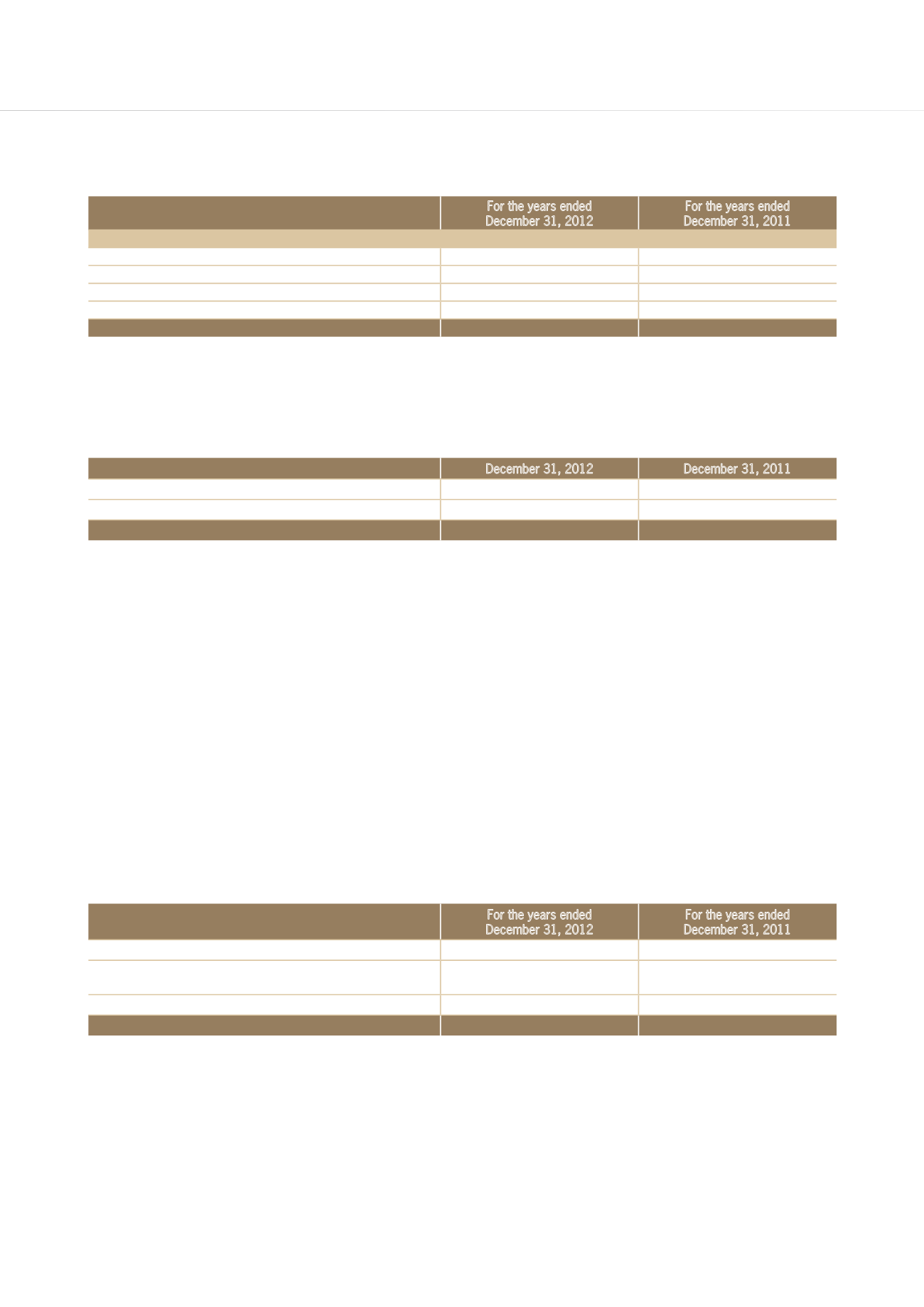

11. CONTRACTED PROJECTS EXPENSES

For the years ended

December 31, 2012

For the years ended

December 31, 2011

Contracted projcets expenses - MOFA

Personnel expense

$532,080,621

$582,927,339

Operating Expense

538,696,768

464,713,973

Travel and transportation expense

61,933,881

71,069,953

Equipment investment expense

28,191,488

38,023,803

$1,160,902,758

$1,156,735,068

12. INCOME TAX

Activities and related expenses of the TaiwanICDF are in compliance with “Standard for Non-profit Organizations Exempt

from Income Tax”. Accordingly, the TaiwanICDF is exempt from income tax. The income tax returns through 2010 have

been assessed and approved by the Tax Authority.

13. FUNDS

December 31, 2012

December 31, 2011

Founding Fund

$11,614,338,576

$11,614,338,576

Donated Fund

854,499,496

854,499,496

Total

$12,468,838,072

$12,468,838,072

1) The founding fund balance (NT$11,614,338,576) was derived from the closure of the IECDF management

committee on June 30, 1996. In the official registration with the court, the total property value filed was based on

the closing balance of assets of the IECDF management committee. As of March 13, 2013, the total amount of the

assets registered with TaiwanICDF was NT$15,888,379,324.

2) The donated fund (NT$854,499,496) of TaiwanICDF consisted of the following items:

A. The amount of NT$4,423,541 from MOFA’s Committee of International Technical Cooperation (CITC) was consoli-

dated in TaiwanICDF on July 1, 1997.

B. The amount of NT$600,000,000 was donated by MOFA on January 16, 1999.

C. The MOFA provided the amount of NT$250,075,955 on December 31, 2001 under the Regulation for the

TaiwanICDF in Providing Guarantee for Credit Facilities Extended to Private Enterprises Which Invest in Countries

with Formal Diplomatic Relationships. The TaiwanICDF had fulfilled the obligations of the guarantee amounting to

NT$152,665,834 as of December 31, 2012.

14. ACCUMULATED EARNINGS

The TaiwanICDF is registered as a consortium juridical person with the aim of strengthening international cooperation

and enhancing foreign relations by promoting economic development, social progress and the welfare of the people in

partner nations around the world. As the TaiwanICDF is a non-profit organization, distribution of income is not permitted

in accordance with its Articles of Association.

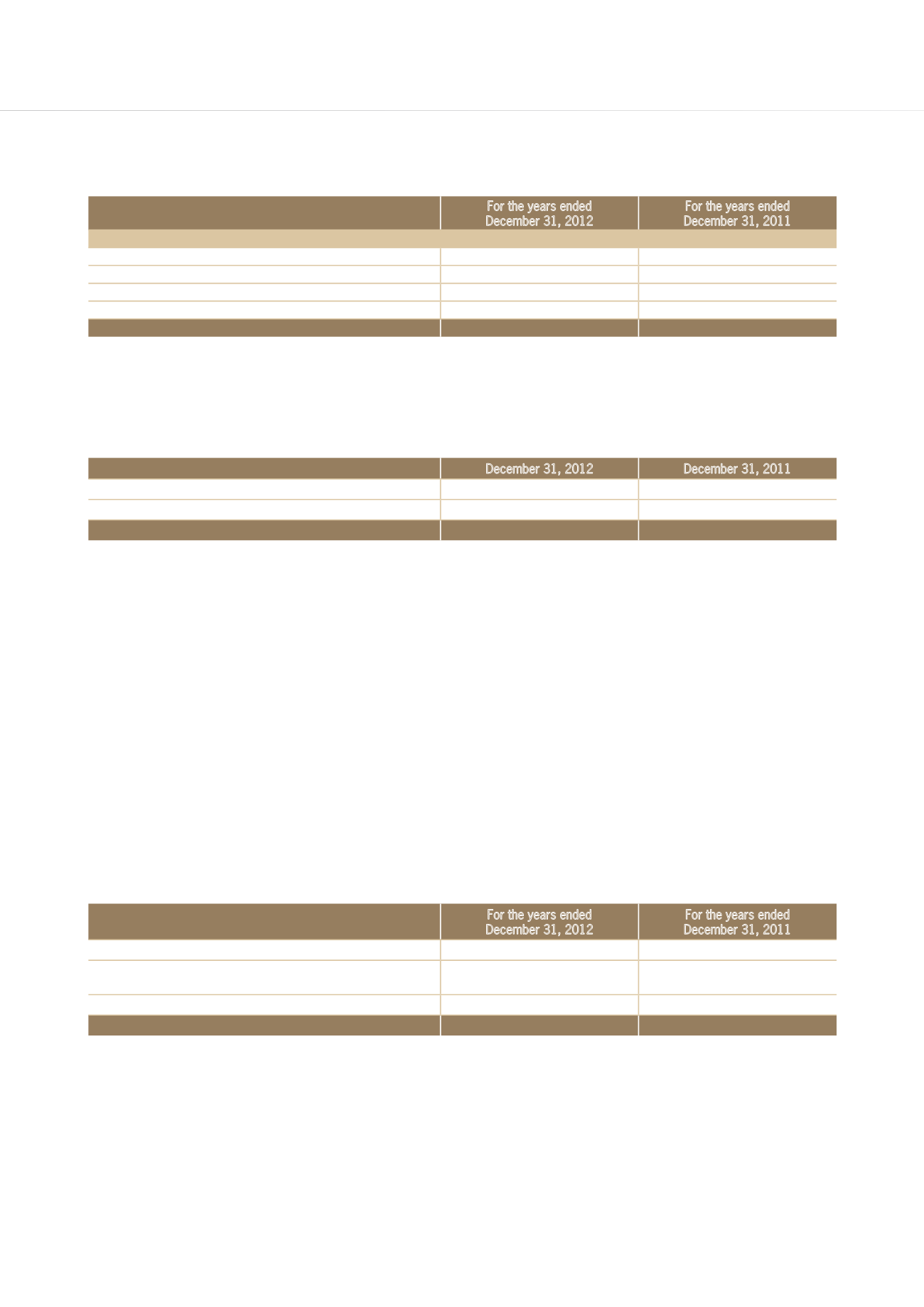

15. OTHER REVENUES

For the years ended

December 31, 2012

For the years ended

December 31, 2011

Reversal of allowance for doubtful accounts

$9,125,688

$–

Income converted from delinquent debts (Nauru Menen Hotel

Reconstruction Project)

–

228,113,264

Other

15,840,687

10,406,271

Total

$24,966,375

$238,519,535

16. RETIREMENT FUNDS

1) The TaiwanICDF contributes monthly an amount based on seven percent of the employees’ remuneration and

deposits it with a financial institution. This fund balance is not reflected in the financial statements. The fund

balance with financial institution were NT$92,318,901 and NT$96,399,979 as of December 31, 2012 and 2011,

respectively.