Administration

63

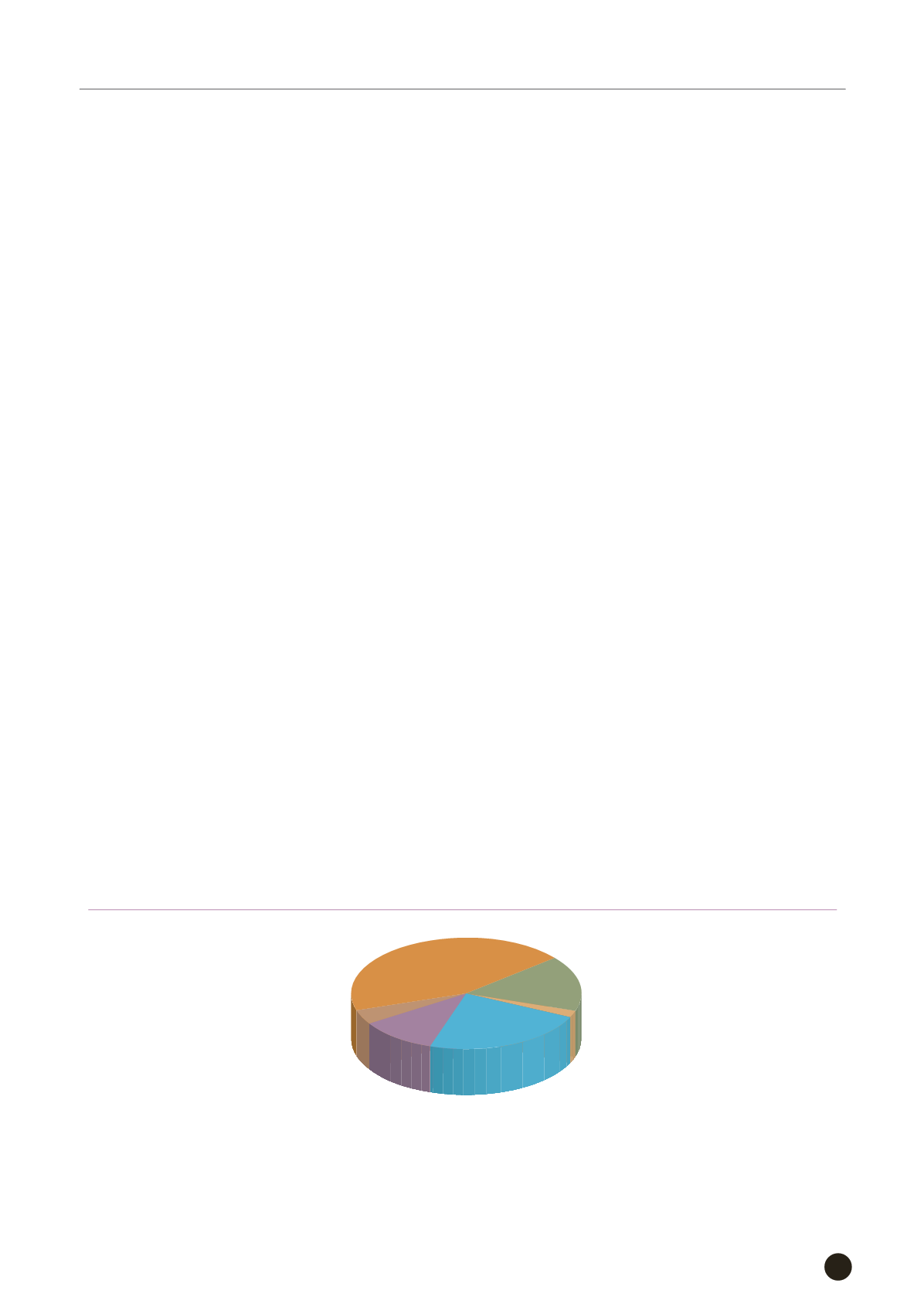

(including disposed exchange-traded funds capital gains

of NT$44.89 million). In 2013 it was 1.58 percent. The

revenue from financial investment plus foreign exchange

and other gains (losses) stood at NT$264.96 million;

which represented an increase of NT$168.09 million, or

174 percent, compared with the budget target. Financial

investment utilization in 2015 is shown in Figure 3.

Accounting Management

The TaiwanICDF’s revenues are derived predominantly

from interest accrued on the Fund and interest from lending

operations and funding for MOFA-commissioned projects.

Interest accrued on the Fund and interest from lending

operations mainly support routine operations, including

technical cooperation projects, humanitarian assistance,

scholarship programs, as well as the TaiwanICDF’s

administrative and management expenses. Income

from MOFA-commissioned projects mainly supports the

operation of overseas technical and medical missions, and

specially commissioned projects.

In 2015, operating revenues and non-operating income

and gains amounted to NT$1.58 billion, of which NT$

1.23 billion was allocated for commissioned projects, an

increase of 21.49 percent from 2014. Revenue generated

through the use of the Fund was NT 374.7 million, a

decrease of 1.95 percent from 2014, of which revenues

from lending and investment operations comprised 29

percent, interest on fund investments 47 percent and cash

dividends 2 percent, with other revenues representing the

remaining share of 22 percent.

Expenditures for 2015 were NT$ 1.52 billion, of

which NT$ 1.23 billion was used for commissioned

projects, an increase of 21.49 percent from 2014.

Expenditures through the use of the Fund were NT$

315.38 million, a decrease of 15.93 percent from 2014.

In 2015, revenue exceeded expenditures by NT$59.32

million compared to the NT$ 7.02 million excess of

expenditures over revenue in 2014, an increase of

NT$52.3 million. This increase in annual dividend

income was mainly due to the implementation of

cost-saving and revenue generating measures to

balance income and expenses, including raising the

proportion of exchange-traded fund holdings; as well,

the natural hedge approach adopted in response

to the U.S. Federal Reserve’s plan to raise interest

rates produced a foreign exchange gain of NT$ 71.75

million. In terms of cutting down on expenses, to make

maximum use of commissioned funds and improve

foreign aid efficiency, part of the operating expenses

were borne by the funds entrusted. At the same time,

the integration of TaiwanICDF and MOFA resources

provided for better synergy of foreign aid and MOFA

injected funds in the amount of US$ 0.25 million to help

the TaiwanICDF in promoting technical assistance. In

addition, Nepal earthquake relief funds were used in

the implementation of two humanitarian aid projects in

the country, indirectly generating savings of US$ 0.4

million in the budget for humanitarian assistance.

Bank Deposits /

Short-term Notes 4%

..........................

Investments for Development

Projects 11%

.........................................

Time Deposits 44%

............................

16% Bonds

...............

2% Index Funds /

Equity Assets

.............

23% Lending for

Development Projects

...........................

Figure 3 Investment Management (2015)