38

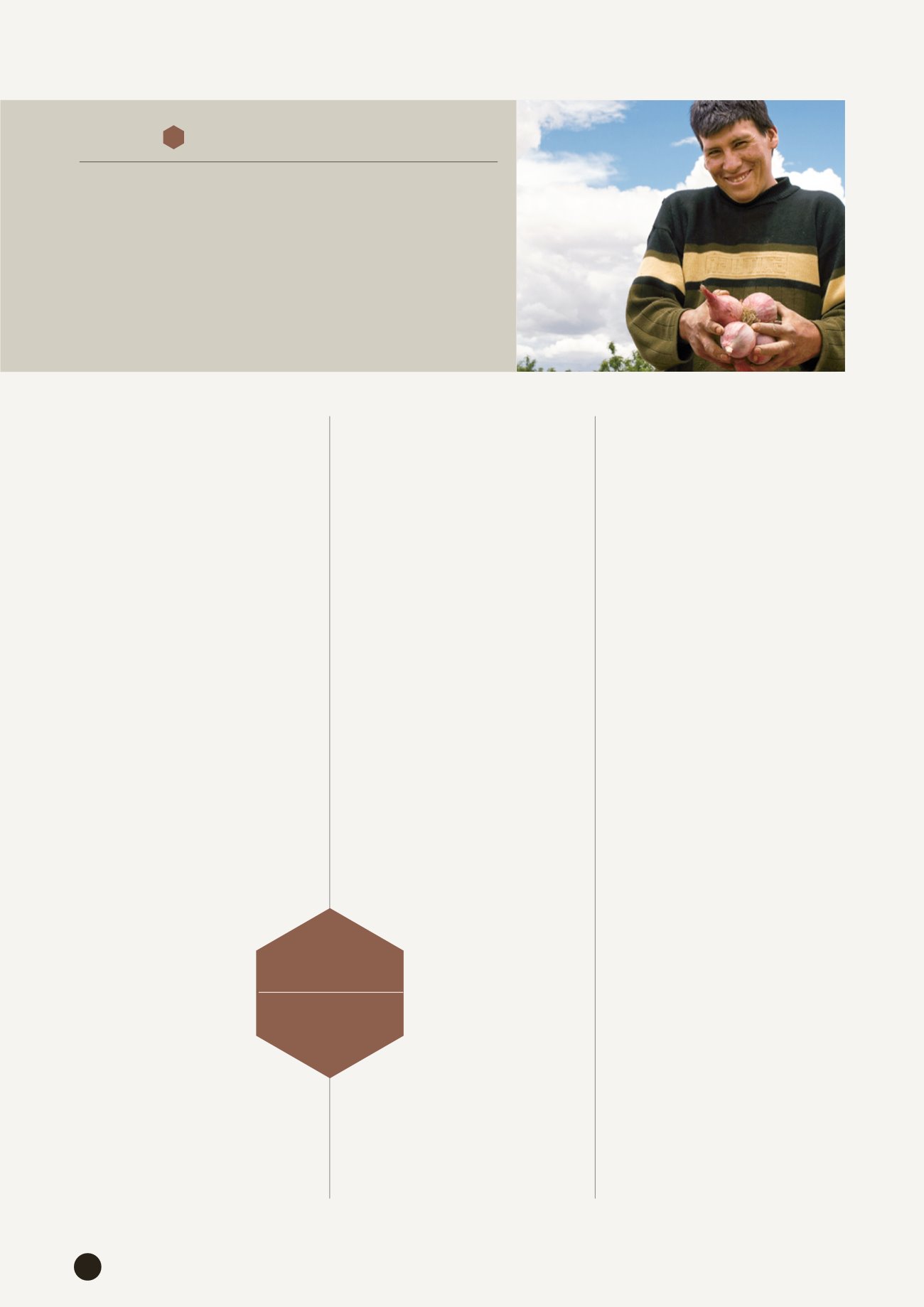

Under our strategy of providing

financial services to spur private

sector development, over the years

the TaiwanICDF has assisted partner

countries in promoting relending

projects for micro, small and medium-

size enterprises (MSMEs). The aim

is to strengthen the functions and

operations of intermediary financial

institutions through fund injection,

making use of relending services to

help MSMEs access capital for their

development, thus achieving the goal

of developing the private sector.

At the end of the 1990s, the

TaiwanICDF began to work with

Central American multilateral

development banks to promote

relending projects to help local

financial institutions provide long-

term stable capital. Following our

successful experience with the

Special Fund model used in the

Central and Eastern Europe region

to implement a relending framework,

we t h e n b e g a n t o

discuss a new type of

cooperation structure

with the Multilateral

I n v e s t m e n t F u n d

(MIF), part of the Inter-

American Development

B a n k G r o u p ( I D B

Group), and, in 2006, an

agreement was officially

signed to implement

t h e S p e c i a l i z e d

Financial Intermediary

Development Fund (SFIDF).

Combining Different Channels

and Increasing Diversified

Financial Services

The TaiwanICDF’s SFIDF and the

Small Enterprise Investment Fund

(SEIF) under the MIF contributed

resources on equal basis to targeted

clients. Through equity investment,

loans and technical assistance, the

SFIDF is able to help local Central

American factoring companies

(accounts receivable financing),

finance companies and micro-

loan institutions strengthen their

institutional capacities, and support

the development of local MSMEs with

innovative financial products.

In the beginning of the SFIDF,

a mechanism for cross-border

remittance was developed in order

to respond to the needs of Central

Americans working in the United

States. This mechanism works as a

funding source, encouraging relatives

in the home country to apply for

mortgages or to use it

for repayment of micro-

loans, or increasing the

willingness of financial

institutions to provide

mortgages to migrant

wo r ke r s . I n recen t

years, for low-income

families and customers

in rural areas, the MIF

has combined other

financial products or

ICT tools so that local

financial institutions can provide

better financial services in line with

different loan conditions and needs.

For example, in El Salvador, the

MIF has transformed accounts

receivable into debt obligations

(certificate of obligatory claim)

through a local factoring company

to develop the factoring market for

small businesses. Also, by providing

technical assistance and loans,

the MIF strengthens the factoring

company’s management mechanism

and stabilizes its source of long-term

loans. In Nicaragua, the MIF uses

both equity investment and loan

to support a factoring company to

develop innovative financial products.

In Ecuador, the MIF focuses on

women customers, assisting a

bank to increase access for women

entrepreneurs to financial or savings

products.

By the end of 2015, resources

provided by the SFIDF have already

assisted over 10 financial institutions

in Nicaragua, El Salvador, Ecuador,

Bolivia, Mexico, etc. The above

examples of innovative financial

services for small businesses, we

believe, can bring inspiration and

benefits to the overall development of

the entire regional financial system for

small businesses.

74,136

Number of local micro,

small and medium-size

businesses supported

Specialized Financial Intermediary

Development Fund

3

Case Study