Apéndice

82

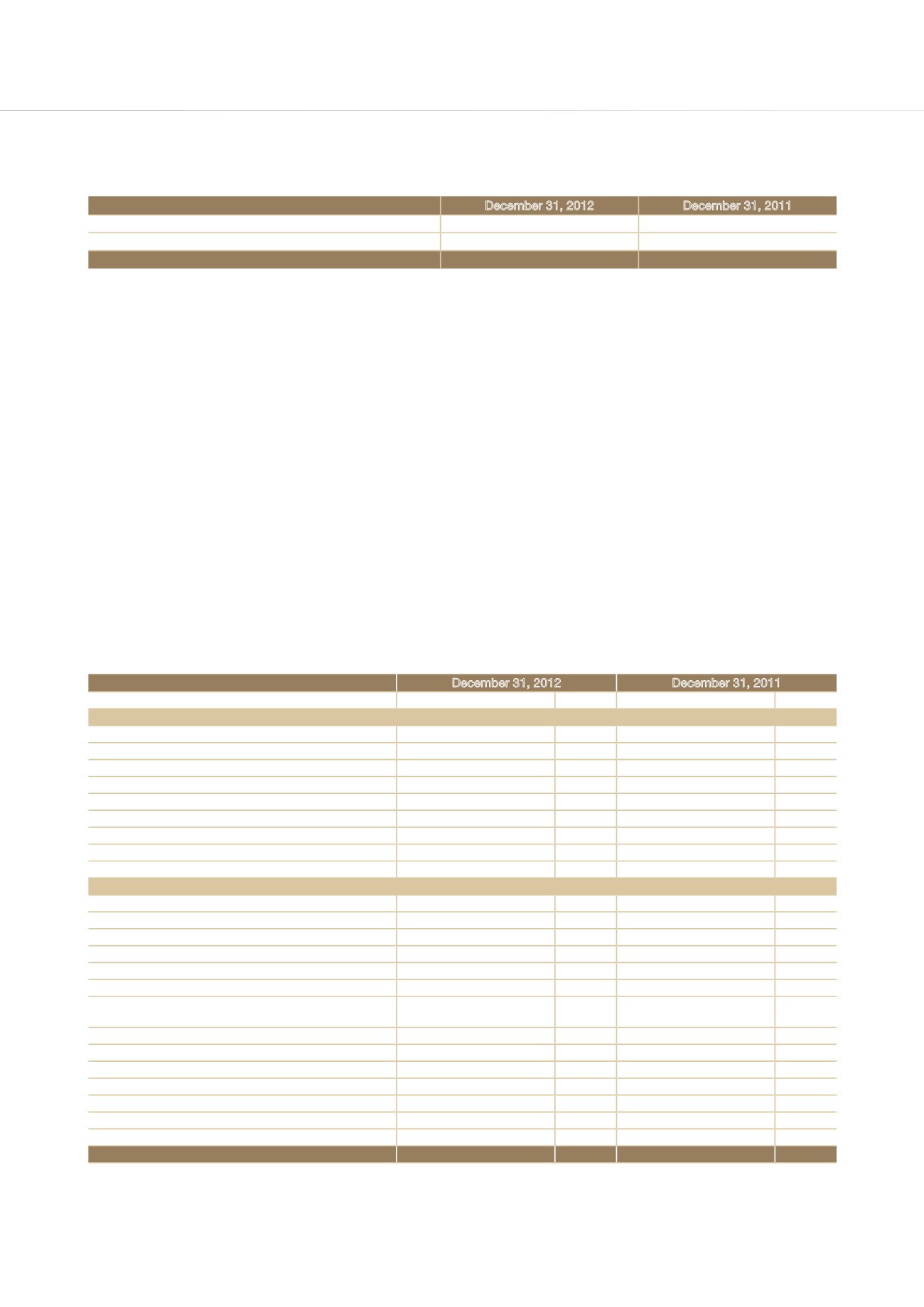

7. LONG-TERM LOANS RECEIVABLE

December 31, 2012

December 31, 2011

Long-term loans receivable

$4,504,183,073

$4,726,833,918

Less: Allowance for doubtful accounts

(115,324,140)

(124,331,377)

Net

$4,388,858,933

$4,602,502,541

1) The TaiwanICDF provides long-term loans in accordance with the Regulations for Loans by the International

Cooperation and Development Fund as approved by the Executive Yuan. As of December 31, 2012 and 2011, the

total outstanding loans denominated in U.S. dollars amounted to US$114,599,746.02 and US$120,719,419.82,

respectively. Moreover, as of December 31, 2012 and 2011, the total outstanding loans denominated in Euro

amounted to €20,837,674.52.

2) Allowances for doubtful accounts were based on the Regulation for the TaiwanICDF Dealings with Past-Due/

Non-Performing Loans and Bad Debts.

3) As Parque Industrial Oriente S.A. (PIO) defaulted on the loan extended for the Industrial Park Development Project

in Paraguay amounted to US$11,003,488.32, the TaiwanICDF filed a legal claim against PIO on September 1,

2003. The court in Ciudad del Este ruled in favor of the TaiwanICDF in the first trial on March 26, 2004. PIO filed an

appeal, which was rejected. Accordingly, it was proposed that the Industrial Park be auctioned off. The guarantor,

MOFA, issued the Letter No. Wai-Jing-Fa 10101172470 on December 31, 2012, committing to the liability year by

year for 3 years beginning from 2012. MOFA had repaid US$5,393,162.77 as of December 31, 2012.

4) In order to acquire the right to operate the Industrial Park, the MOFA, issued the Letter No. Wai-Jing-Mao

09333002180 requesting the TaiwanICDF to establish the private Paraguay Synthetic Corporation, which has

a registered US$10,000 share capital in Panama on its behalf. The TaiwanICDF assisted Paraguay Synthetic

Corporation to submit a bid of US$7,100,000 and acquired the title to the land of the Industrial Park.

5) There was no significant past-due loan as of December 31, 2012 and 2011.

6) See Appendix 1 for the statement of changes in long-term loans for the year ended December 31, 2012.

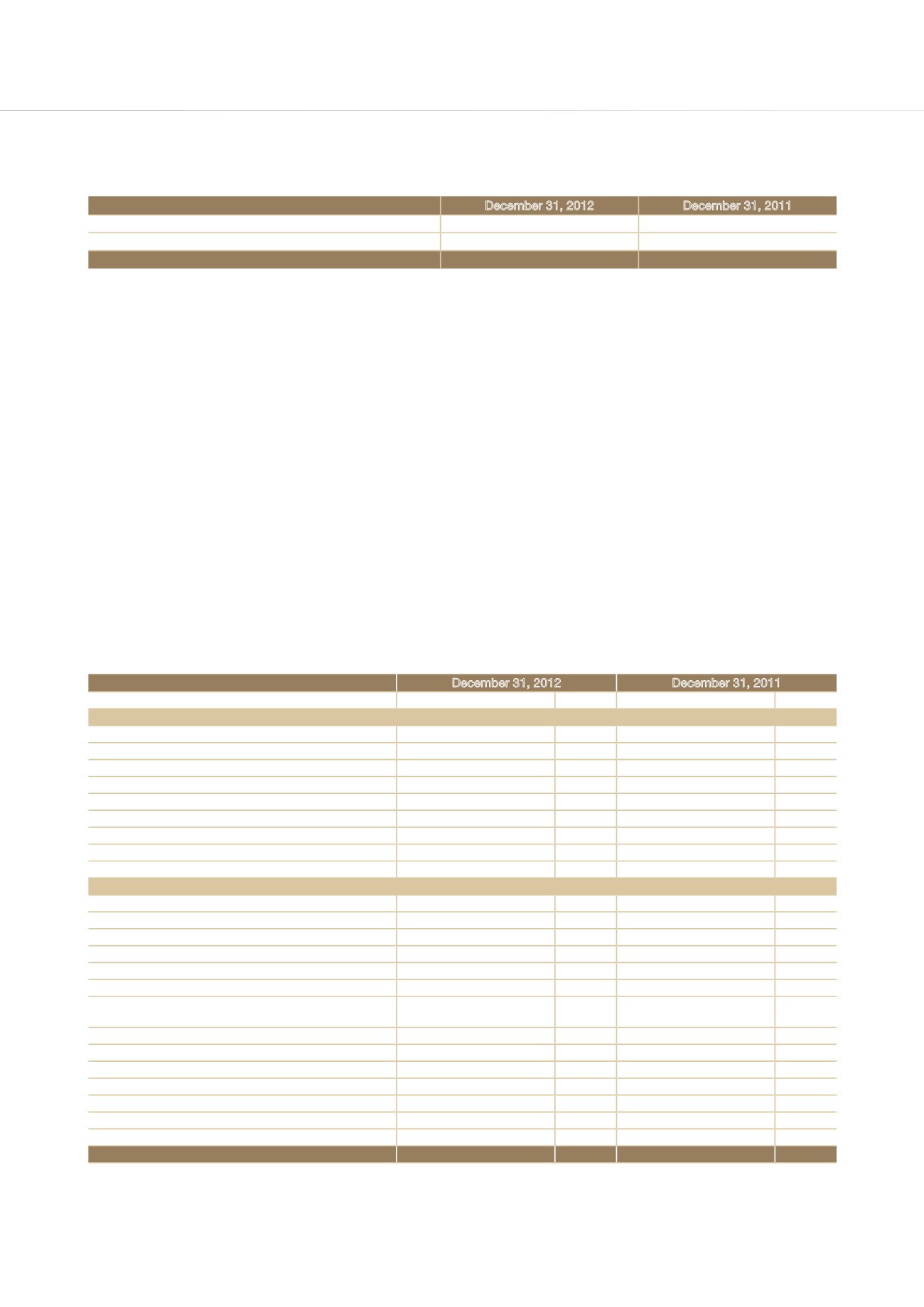

8. FINANCIAL ASSETS CARRIED AT COST

December 31, 2012

December 31, 2011

Carrying Amount (NT$)

Ownership Carrying Amount (NT$)

Ownership

Equity investments accounted for using cost method:

Overseas Investment & Development Corporation

$130,000,000 14.44%

$130,000,000 14.44%

Less: Accumulated Impairment

(6,000,000)

(6,000,000)

124,000,000

124,000,000

BTS India Private Equity Fund Limited

121,991,506 6.8%

119,956,818 6.77%

(=US$3,907,120)

(=US$3,839,093)

Less: Accumulated Impairment

(10,806,485)

(10,806,485)

(=US$329,466)

(=US$329,466)

111,185,021

109,150,333

235,185,021

233,150,333

International institution investment fund:

FIISF-Small Business Account

325,000,000

325,000,000

(=US$10,000,000)

(=US$10,000,000)

FIISF-Small Business Account II

330,660,000

330,660,000

(=US$10,000,000)

(=US$10,000,000)

FIISF-Small Business Account III

231,520,000

231,520,000

(=US$8,000,000)

(=US$8,000,000)

MIF-Specialized Financial Intermediary

Development Fund

476,300,000

476,300,000

(=US$15,000,000)

(=US$15,000,000)

FIISF-Trade facilitation programme

161,750,000

161,750,000

(=US$5,000,000)

(=US$5,000,000)

Less: Accumulated Impairment

(161,750,000)

(161,750,000)

(=US$5,000,000)

(=US$5,000,000)

–

–

1,363,480,000

1,363,480,000

$1,598,665,021

$1,596,630,333